Home loan tax saving calculator 2020

05212020 04252020 by Amit Bansal. Tax rates are determined by local tax authorities by dividing the amount of revenue they need to meet their budget by the total assessed value in the tax jurisdiction.

Home Loan Emi Calculator 2022 Free Excel Sheet Stable Investor

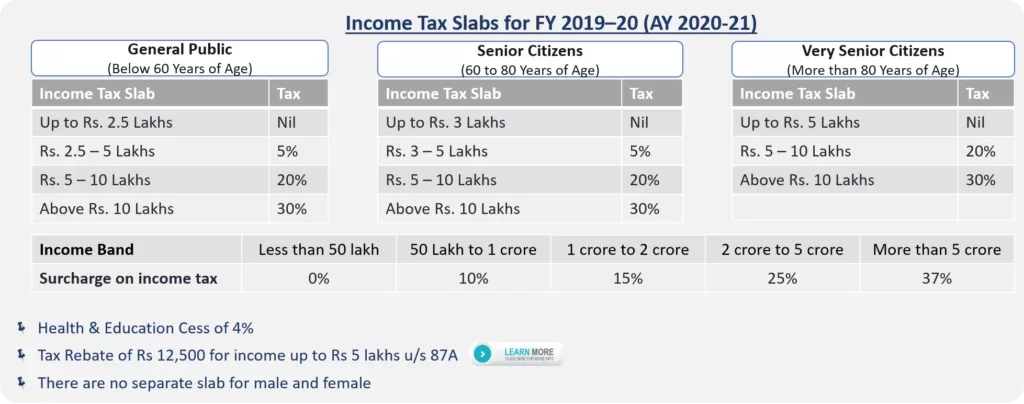

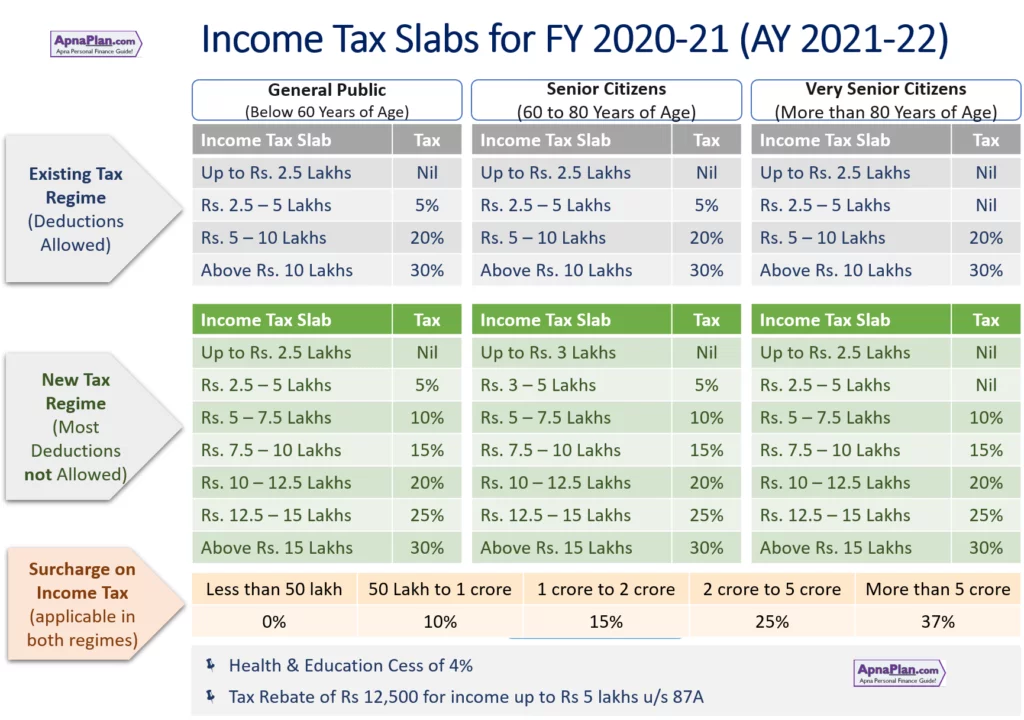

Effective from April 1 2020 an individual salaried taxpayer has been given the option to continue with the old tax regime and avail deductionstax exemptions such section 80C 80D deductions HRA LTA tax exemptions etc.

. Check your tax code - you may be owed 1000s. Interest paid on housing loan taken for a rented out property can be claimed as deduction under section 24b even in the new proposed tax regime. Rs 150 lakhs per annum.

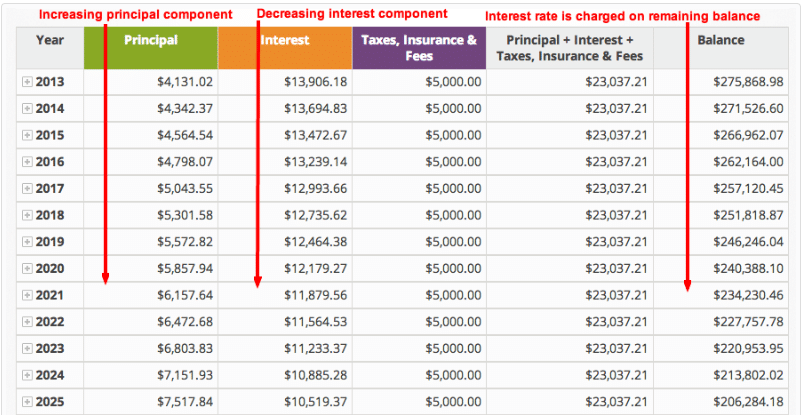

A tax payer has been given the option of moving to this new regime for. The government has once again extended the deadline to file income tax return ITR for FY 2020-21 by three months to December 31 2021 from September 30 2021. Consider the above case where a person took home loan of Rs30 lakhs 85 pa for 20 years.

ClearTax is fast safe and easy for ITR E-Filing. Calculate your EMI download Home loan EMI calculator in excel. LENDER APR LOAN AMOUNT RANGE LOAN TERMS MAX LTV.

Relevant Sections in the income tax law. To help you see current market conditions and find a local lender current Redmond mortgage refinance rates are published in a table below the calculator. With so many ways to tailor your loan to.

An in-depth guide offering money saving tips appears below the calculator. While on adjustable rate home loans there are no prepayment charges on fixed rate home loans lenders usually charge a penalty of 2 percent of the amount being prepaid through refinance ie. Individuals taking a home loan jointly can avail home loan tax benefits individually.

The deadline has been extended due to the glitches on the new income tax portal which had made it difficult for many taxpayers to complete their ITR filing process. Amount of Income Tax Deduction for Payment of Housing Loan Interest us 24. Tax rates are expressed in mills which is equal to.

When you borrow to prepay your home loan. Relevant Sections in the income tax law. Please note this calculator is for the 2022 tax year which is due in April 17 2023.

Its popularity is due to low monthly payments and upfront costs. Maximize your deductions by handling all deductions under Section 80 the rest. Home equity loan calculator.

Our homeownership tax benefits guide includes a more detailed calculator which enables users to input more data to get a more precise calculation has been updated to include 2020 standard decutions and the new. But in April 2020 the Fed deleted the six. Due to this prepayment he could save Rs534832 on interest.

2 lakh on their home loan. How to SAVE Capital Gain Tax Home loan EMI Calculator excel. Home equity line of credit HELOC calculator.

Saving for a goal such as saving for a home purchase or a vacation. Income Tax Deduction for Home Loan Repayment of Principal Amount us 80C. Why BMO Harris Bank is the best home equity loan for different loan options.

4Up to 2000yr free per child to help with childcare costs. South Carolina Property Tax Rates. Calculate the total amount you can claim as a tax deduction.

Loan amounts range from 25000 to 150000 with terms of five to 20 years. Hand over the home loan interest certificate to your employer for adjusting the TDS. These ten banks are providing loans with the most affordable interest rates.

15000 750000 up to 1 million for properties in California Up to 30 years. Home Loan Basics Amount. The process to claim tax benefits on a home loan is easy and simple.

2Transfer unused allowance to your spouse. All borrowers pay the same spread that a certain bank charges but each borrower pays a different risk premium. Is home loan tax deductible in 2020-21.

Free tax code calculator. This implies that if two individuals have applied for a joint home loan each can claim tax benefit of up to Rs. File Income Tax Returns ITR for FY 2021-22 AY 2022-23 online with ClearTax.

Or to opt for the new tax regime and forgoing approximately 70 deductions and tax exemptions. 3Reduce tax if you wearwore a uniform. Enter your filing status income deductions and credits and we will estimate your total taxes.

A home loan calculator helps you know the amount of the EMIs that you will need to pay towards your home loan and helps make an informed decision. Todays national mortgage rate trends. Budget 2020 has proposed a new tax regime with lower tax slab rates along with removal of almost all deductions exemptions.

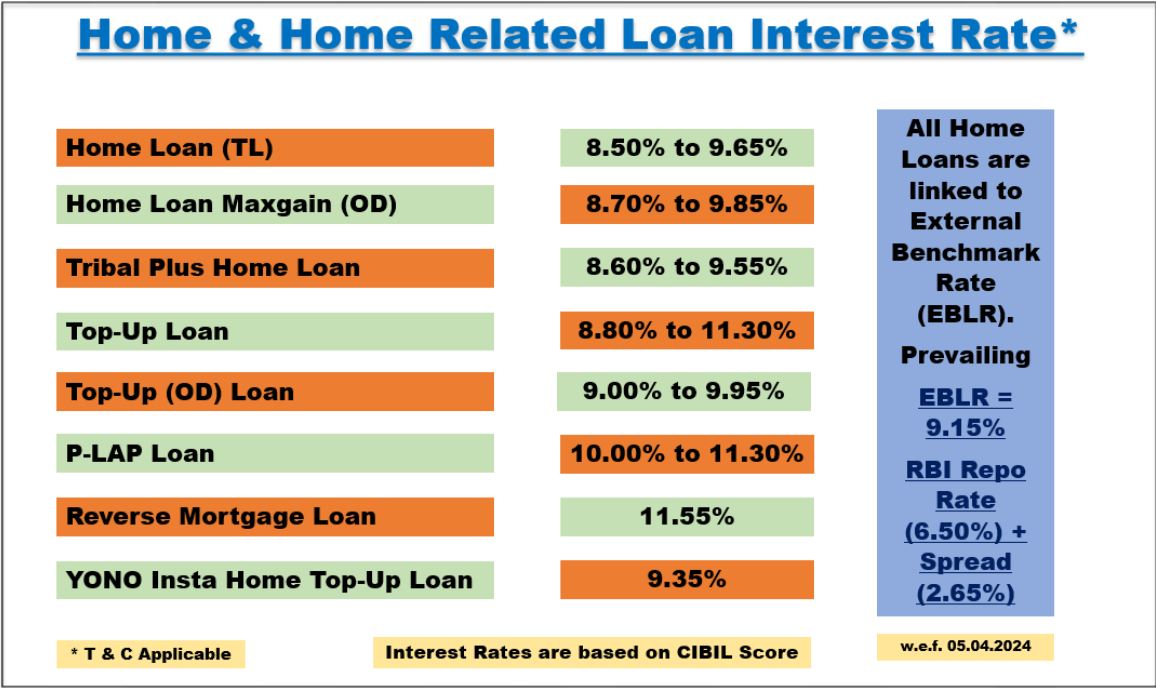

The average cost of private mortgage insurance or PMI for a conventional home loan ranges from 058 to 186 of the original loan amount per year according to Genworth Mortgage Insurance. Please remember that the repo rate will be changed by the RBI every two months. ClearTax handles all cases of Income from Salary Interest Income Capital Gains House Property Business and Profession.

Earn 100 switching bank. Tax deductions allowed on home loan interest. LIC Housing Finance Limited LICHFL offers affordable home loan options ranging from Rs1 lakh to Rs15 crore at attractive interest rates starting from 690 pa.

Upper limit on tax rebate for senior citizens. Financial analysis is provided for an initial period selected by the user subsequent years throughout the duration of the loan term. Rs 2 lakhs per annum.

Tax deductions allowed on home loan principal stamp duty registration charge. The decision to prepay your home loan should be considered after accounting for the cost of prepayment. 15 lakh and Rs.

As of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market. Upper limit on tax rebate. Make sure the residential property is in your name.

Yes interest on home loan can be claimed under section 24 and 80EEA. Suppose this person made a prepayment of Rs150000 in the first 12th month. Applying for a home loan jointly not only enhances your home loan eligibility but also the tax benefits.

For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. The first calculator figures monthly home payments for 30-year loan terms. In the case of rented property full amount of interest paid is allowed as deduction.

Cash Out Mortgage Refinancing Calculator. Income Tax Saving on Home Loan for FY 2020-21 AY 2021-22 Who can claim tax benefit on home loan. In case of a joint home loan ensure you are the houses co-owner.

1040 Tax Estimation Calculator for 2022 Taxes. Interest paid on home loan is eligible for deduction of Rs2 lakh if the house property is self occupied. You can change the loan term or any of the other inputs and results will automatically calculate.

Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS. And with flexible tenures going up to 30 yearsThe applicable processing fee is. Trusted by hundreds of CAs and.

5Take home over 500mth. Conditions for claiming home loan deduction under 80C.

Sbi Home Loans Nri Home Loan

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How To Calculate Income Tax On Your Salary For Fy 2021 22

Can I Afford To Buy A Home Mortgage Affordability Calculator

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Schedule C Income Mortgagemark Com

Conventional Mortgage Calculator What Is A Conventional Home Loan Prequalify Calculate Your Monthly Payments Today

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How To Calculate Amortization Expense For Tax Deductions

Loan Prepayment Calculator Saving Lakhs On Home Loan Now Getmoneyrich

Section 80ee Deduction For Interest On Home Loan Tax2win

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Loan Prepayment Calculator Saving Lakhs On Home Loan Now Getmoneyrich

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

Property Tax How To Calculate Local Considerations

Rebate Under Section 87a Ay 2021 22 Old New Tax Regimes